This is a concept I learned from an excellent piece by Ayo Omojola. Read the essay here.

One of the biggest differentiators in B2B lending is 'pre-income servicing', or the ability of a lender to get paid before a borrower does. Both merchant platforms and aggregators have this unique advantage over other types of lenders.

Let’s start with merchant platforms.

Merchant Platforms

For our purposes, merchant platforms can be understood as software applications that facilitate payments and other functionality on behalf of a business.

For example, as a payments processor, Square stands directly in the path between a merchant and its customers. This makes it possible for its lending arm, Square Capital, to intercept receipts and get paid before the borrower does.

Compare this to a bank or a lending startup: since they are generally uninvolved in the merchant's core business, they are stuck on the sidelines, hoping they get paid.

This advantage makes it possible to make better underwriting decisions (since the platform has direct access to merchant receipts) and ensure higher rates of pay off.

Other examples of platforms: Paypal and Stripe.

Companies that could move into this space next: HR applications like Gusto, Zenefits, and Rippling.

Aggregators

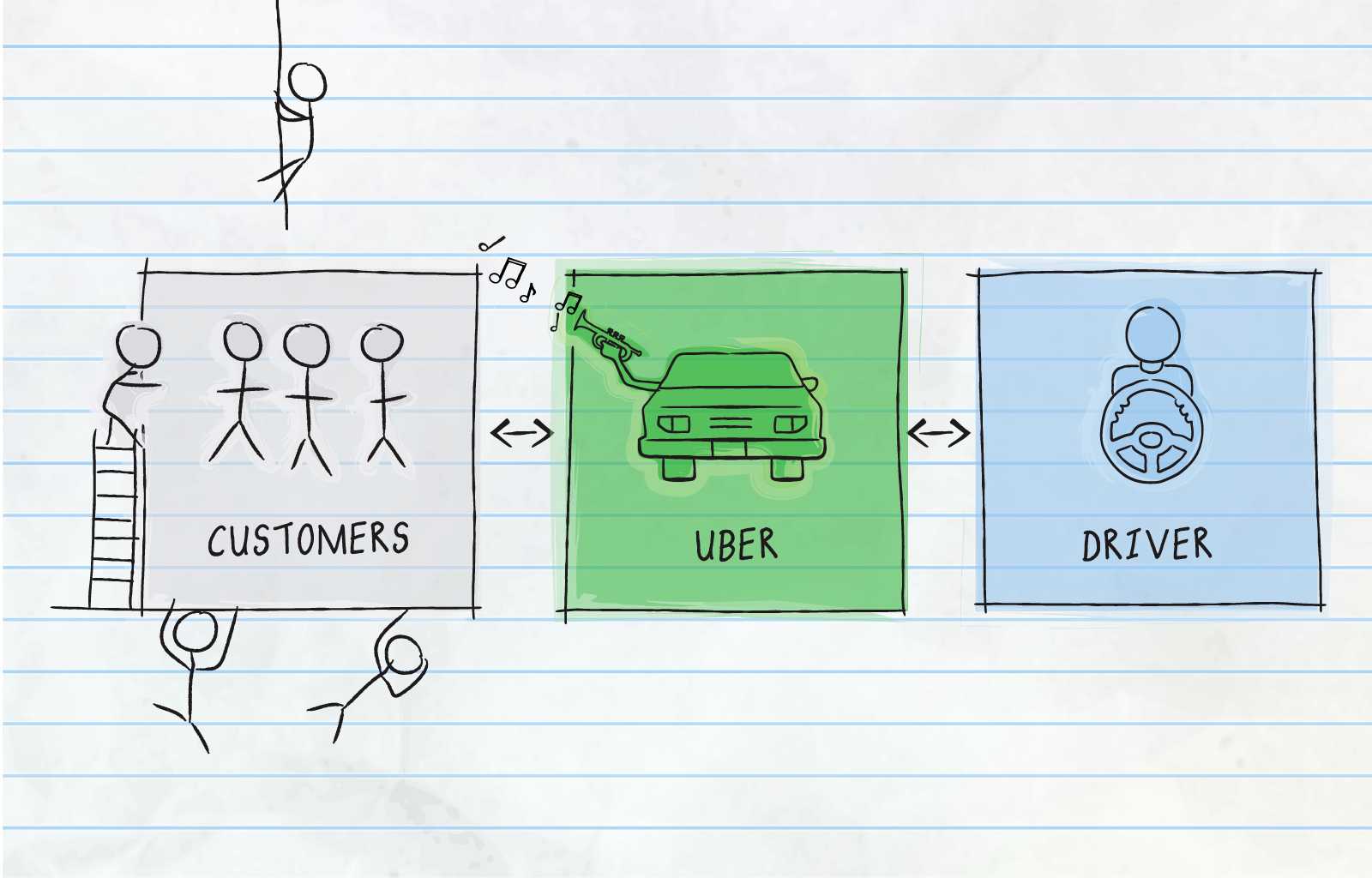

Aggregators have an additional advantage beyond merchants. We are using the term aggregator to describe a service that facilitates a multi-sided marketplace (see Ben Thompson’s excellent article defining aggregators). An aggregator does more than just facilitate payment - it creates market demand for a merchant's service, which is where the additional advantage potentially comes into play.

Take Uber as an example. Uber can make a loan to a merchant. It can then implement pre-income servicing, by taking payment for the loan out of the driver's fees.

So far, this is similar to the advantage that platforms have. However, Uber can also help the borrower by directing more customers to them, so that they are better able to pay back the loan. This improves the quality of the loan for Uber, since the driver is now much more likely to repay the loan in full.

Other examples of aggregators: AirBnB, Etsy, Ebay.

Pre-income servicing is a huge competitive advantage in the lending industry, and it poses a serious threat to banks and other lending institutions that are stuck on the sidelines.