It’s the summer of 2021 and as travel restrictions relax, consumers are taking to the skies.

‘Revenge travel’ is an emerging trend as people go on vacations and family trips put off by the pandemic. And with so many travelers eager to see the world after sheltering in place for a year, the demand for vacation, and the funds to cover them, is sure to rise.

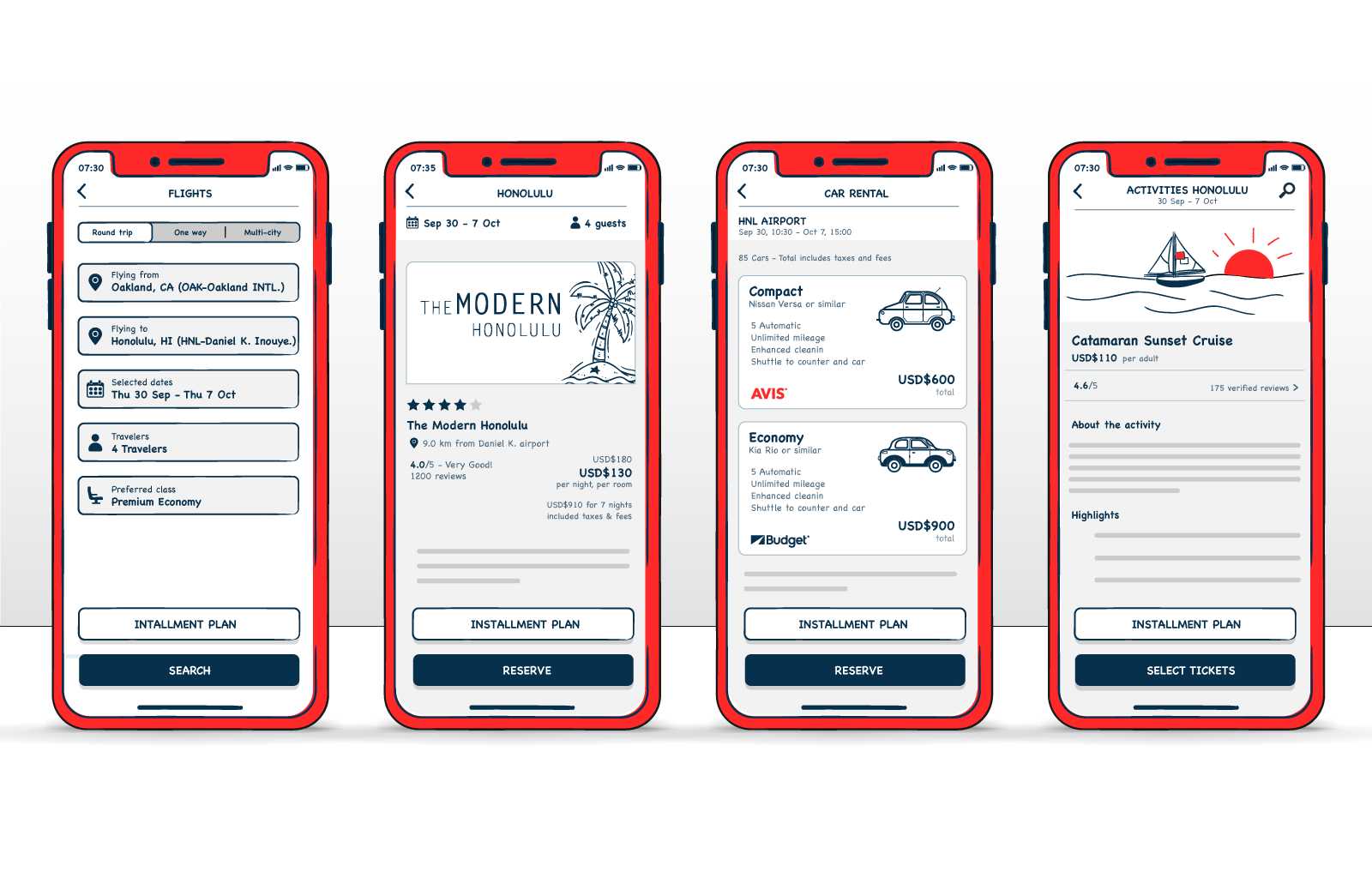

Imagine if companies like Expedia offered loans in-app and online. Travelers could book their flight, hotel, rental car, and activities—and get funds to cover them all—with just a few clicks. Customers would get everything they need for their trip in one place, and Expedia would have a robust new revenue stream.

Sound unlikely? Not necessarily. Digital lending rapidly advanced in recent years, and the space has never been more competitive. From installment programs to wage advancement, and for travel, car, and real estate loans, fintech makes it possible for almost any company to offer digital financing as part of the customer journey.

The Complete Loan Journey Has a New Starting Line

Today’s consumers can (and do) shop for the best rates online before committing to a loan. This makes it harder for lenders to differentiate in other areas. With digital lending offers built-in to purchase experiences, however, it’s easier for lenders to target their audience based on affinity, as well as cross-sell and upsell to generate and retain borrowers.

Done right, digital lending platforms integrate seamlessly into existing customer experience journeys. This makes it possible to capture potential borrowers right where they’re shopping, such as on apps and sites similar to Expedia’s.

It also makes it possible to expand a company’s offerings to increase loyalty and revenue. However, this requires a little homework. Before diving into digital lending, companies must:

- Establish product-market fit. Taking a holistic approach, consider your customers, audience, ecosystem, and the digital lending product you want to introduce. Where is the most demand? What, if any, are the limitations of what you can deliver? Survey customers to paint a detailed picture.

- Discover opportunities based on affinity. How can you leverage what you know about your audience to develop new products or upsell existing ones? Do you want to be a part of payments? Help sell the product? These answers will be unique to your industry, audience, and existing products.

- Find your blindspots. Will you provide a digital wallet and/or dashboard? How will communications get handled? Security? KYC? Account linking? Content management? There are many factors to consider, and each may need its own dedicated solution.

Finally, you’ll also want to consider whether your product can be extended to in-person purchases and whether partners such as restaurants and retailers will want to advertise special offers on your app. Capabilities like this expand your audience and further embed lending into the customer journey.

The Right Tech Stack Ensures Functionality and Compliance

Building a complete digital lending product requires the right tech stack. Once you’ve built out the vision for your product, you’re ready to pinpoint which partners and tools are the best fit for your needs. A balance of fintech partners and in-house digital agility keeps solutions ready for whatever the future brings.

To begin, consider the most important parts of your customer journey from beginning to end. In the case of a travel company, for example, this includes the discovery/research process, booking, traveling, and returning home. Don’t forget that during this journey, customers often benefit from behavioral nudges as well as reinforcement when they perform desired behaviors.

CapitalOne has leveraged a deep understanding of their customer journey with their Auto Navigator. When a customer begins shopping for a car loan in-app or online, they can click through to “Find Cars” at any point in their discovery process or as soon as they learn how much funding they pre-qualify for. Customers then shop for cars immediately or locate car dealerships in their area in-app.

In addition to the customer experience, you obviously can’t ignore requirements from your governing agencies. You’ll need to build solutions for or partner with fintechs who can:

- verify identities, employment, and income

- handle onboarding and KYC

- maintain SOC2 compliance

And, of course, remember to plan for any necessary underwriting and risk analysis.

Partner With Kunai to Build and Own Your Digital Lending Products

Kunai creates seamless customer experiences that unite digital products with fintech. We partner and build with the leading fintech infrastructure companies, taking digital concepts from napkin sketch to deployment at scale.

Thanks to our experience, we know and understand the customer journey and can see around corners, predicting the next need before it arises. We also have accelerators, reducing your time to market and time to value while increasing your product’s success. Get in touch if you’d like to learn more.